OVERVIEW

- According

to the Executive Office of Labor and Workforce Development, the state’s

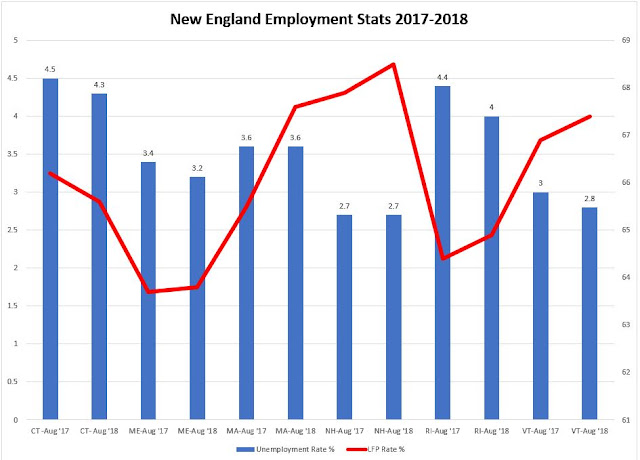

total unemployment rate dropped one-tenth of a percentage point to 3.5 percent

in October.

- According to the federal

Bureau of Labor Statistics, the state also added 4,400 jobs in October.

- The state’s unemployment rate was two-tenths of

a percentage point lower than the national average of 3.7 percent.

- The state’s Labor Force Participation Rate (LFP)

continued to improve since October 2017. It now stands at 68.0 percent, an

increase of 2.6 percentage points. October estimates show 3.69 million

residents were employed in Massachusetts.

- The largest private sector percentage job gains over the past year took place in the

Construction (+5.4); Professional, Scientific and Business Services (+5.1);

Information (+2.0); and Education and Health Services (+1.9).

- Meanwhile, Financial Activities; Leisure and

Hospitality each lost 400 jobs while Government lost 300 jobs.

ANALYSIS

The Massachusetts economy steamrolls ahead. By adding 4,400 jobs, the state’s economy showed no signs of slowing down.

"The Massachusetts unemployment rate continues to remain low at 3.5 percent and has now held below 4 percent for 30 consecutive months. With the Commonwealth's consistently low rate of unemployment, the economy continues to add jobs at a healthy clip and our labor force continues to grow to meet employment needs," Labor and Workforce Development Secretary Rosalin Acosta said.

The job market is so attractive that the October labor force increased by 10,800. Employers are competing for talent.

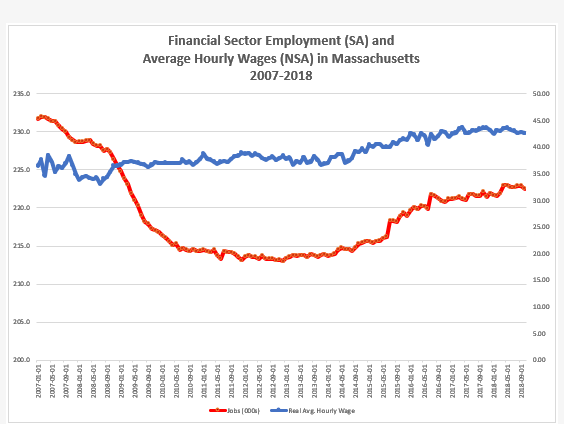

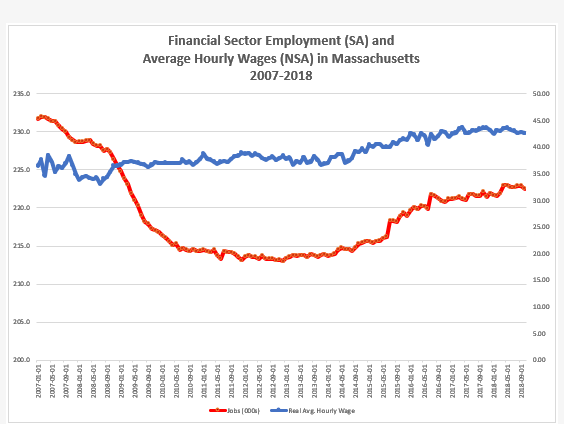

Consolidation in the state’s financial sector has been gradual. The state’s financial sector has not appreciably grown as the economy recovered from the Great Recession.

In February 2007, 10 months before the recession began, the sector employed 232,000 workers; today it employs 222,000 workers on a seasonally adjusted basis.

However, wages in the sector have increased in real terms. The average hourly wage for financial workers in January 2007 was $36.45 compared to today’s average hourly wage of $42.55. The ascent in wages picked up slightly in July 2007 as jobs in the sector began to recover.

As defined by the BLS, the financial sector classification includes finance, insurance, real estate, rental and leasing subsectors.