This just in from the Executive Office of Labor and Workforce Development:

BOSTON, MA (March 13, 2020)– The state’s January total unemployment remained unchanged at 2.8 percent for the sixth consecutive month following on the Bureau of Labor Statistics’ annual revisions, the Executive Office of Labor and Workforce Development announced Friday.

The Bureau of Labor Statistics’ preliminary job estimates indicate Massachusetts added 11,800 jobs in January. Over the month, the private sector added 11,100 jobs as gains occurred in Trade, Transportation, and Utilities; Education and Health Services; Professional, Scientific, and Business Services; Financial Activities; Leisure and Hospitality; Other Services; Information; Construction; and Manufacturing.

From January 2019 to January 2020, BLS estimates Massachusetts added 33,400 jobs.

The January unemployment rate was eight-tenths of a percentage point lower than the national rate of 3.6 percent reported by the Bureau of Labor Statistics.

"Following year-end revisions, BLS now estimates Massachusetts added 33,400 jobs over the year. In addition to those job gains, the labor force increased by 27,000 from last year’s level, with 39,400 more residents employed and 12,300 fewer residents unemployed," Labor and Workforce Development Secretary Rosalin Acosta said.

The labor force increased by 1,900 from 3,834,300 in December, as 2,300 more residents were employed and 400 fewer residents were unemployed over the month.

Over the year, the state’s seasonally adjusted unemployment rate dropped three-tenths of a percentage point.

The state’s labor force participation rate – the total number of residents 16 or older who worked or were unemployed and actively sought work in the last four weeks – remained unchanged at 67.9 percent. Compared to January 2019, the labor force participation rate is up two-tenths of a percentage point.

The largest private sector percentage job gains over the year were in Information; Education and Health Services; Professional, Scientific, and Business Services; and Construction.

Annual revisions to the job estimates show growth was greater than previously published for 2018 and less in 2019. In 2018, 42,700 jobs were added over the year. In 2019, estimates indicate 26,100 jobs were added over the year. BLS annually updates job estimates for each state with the most up-to-date information supplied by employers.

Annual year-end revisions show the unemployment rates were slightly lower than the previously published estimates for August 2019 through November 2019. The labor force estimates were lower than previously published estimates for 2015 to 2019.

January 2020 Employment Overview

Trade, Transportation and Utilities added 3,400 (+0.6%) jobs over the month. Over the year, Trade, Transportation and Utilities gained 2,900 (+0.5%) jobs.

Education and Health Services added 2,000 (+0.2%) jobs over the month. Over the year, Education and Health Services gained 11,700 (+1.4%) jobs.

Professional, Scientific and Business Services added 1,600 (+0.3%) jobs over the month. Over the year, Professional, Scientific and Business Services gained 7,000 (+1.2%) jobs.

Financial Activities added 1,100 (+0.5%) jobs over the month. Over the year, Financial Activities gained 1,300 (+0.6%) jobs.

Leisure and Hospitality added 800 (+0.2%) jobs over the month. Over the year, Leisure and Hospitality gained 2,100 (+0.6%).

Other Services added 800 (+0.6%) jobs over the month. Over the year, Other Services are up 100 (+0.1%) jobs.

Information added 600 (+0.6%) jobs over the month. Over the year, Information gained 3,600 (+3.9%) jobs.

Construction added 500 (+0.3%) jobs over the month. Over the year, Construction has added 1,000 (+0.6%) jobs.

Manufacturing added 300 (+0.1%) jobs over the month. Over the year, Manufacturing lost 1,500 (-0.6%) jobs.

Government added 700 (+0.2%) jobs over the month. Over the year, Government gained 5,200 (+1.1%) jobs.

Labor Force Overview

The January estimates show 3,729,900 Massachusetts residents were employed and 106,200 were unemployed, for a total labor force of 3,836,100. The unemployment rate remained steady at 2.8 percent. The January labor force increased by 1,900 from 3,834,300 in December, as 2,300 more residents were employed and 400 fewer residents were unemployed over the month. The labor force participation rate, the share of working age population employed and unemployed, remained unchanged at 67.9 percent. The labor force was up 27,000 from the 3,809,100 January 2019 estimate, with 39,400 more residents employed and 12,300 fewer residents unemployed.

Detailed labor market information is available at www.mass.gov/lmi.

Showing posts with label Labor force participation. Show all posts

Showing posts with label Labor force participation. Show all posts

Friday, March 13, 2020

Friday, May 3, 2019

Note on the April 2019 U.S. Employment Situation: U-Rate 3.6%; Jobs +263,000

OVERVIEW

ANALYSIS

This month’s report is a rebounding blockbuster, considering two months ago the U.S. stock market and policy makers were stunned by the creation of only 56,000 jobs. (The original number was 33,000).

Wall Street estimated the April payrolls number at 185,000 jobs. Earlier in the week, the ADP National Employment Report, estimated the creation of 275,000 new private sector jobs; the BLS reported private sector job creation at 236,000 jobs.

Retail trade changed little in April; the sector was down 12,000 jobs but the motor vehicle and parts dealers subsector added 8,000 jobs. General merchandise stores suffered a loss of 9,000 jobs.

Revisions to previous reports were mixed. The February payrolls number was revised upward to 56,000 from 33,000 and the March number was revised down from 196,000 to 189,000. Still the revisions identified 16,000 more jobs than previously reported. The three-month moving average settled at 169,000 per month. Similar revisions from the earlier three months resulted in a three-month average of 180,000.

The unemployment rate of 3.6 percent is the lowest since 1969.

The current economy, based on supply-side reforms, is benefiting workers and instilling confidence in consumers. Not so long ago, market watchers were worried about the slowdown in consumer spending as a bellwether of an almost certain downturn.

On Thursday, the BLS reported than nonfarm business sector labor productivity increased 3.6 percent in the first quarter of 2019, with output increasing by 4.1 percent and hours worked increased 0.5 percent. Along with productivity (another blow-out number), the job market is at a sweet spot.

Today’s report noted that average hourly earnings over the past year have increased by 3.2 percent. Workers and consumers are more careful about how they treat homeowner equity which is 16 percent higher than 2006, the advent of the Great Recession. Apparently increased wages serve as a bulwark against reckless home equity borrowing.

As a result, workers are saving more. The article to read is “Why Are Americans Suddenly Saving?” by Matthew C. Klein in Barron’s on April 22, 2019.

Source: Author’s calculations based on BLS and US Census historical data (Total Retail Sales)

Conte Consulting: Editorial Services | Web Content Design & Management |Public Policy Analysis

- Total non-farm payroll employment increased by 263,000 and the unemployment rate declined to 3.6 percent, moving down 0.2 percentage point from the previous month according to the Bureau of Labor Statistics.

- The Labor Force Participation (LFP) rate declined by 0.2 percentage point to 62.8 percent. Nonetheless, the rate was unchanged from a year ago. The Employment-Population ratio also remained at 60.6 percent. Since October 2018, the rate has been either 60.6 percent or 60.7 percent.

- Professional and Business Services (+76,000) and Construction (+33,000) led all sectors in the April payrolls. Employment in Health Care (+27,000) did not finish in the top two sectors for growth but along with Professional Services (+535,000) added the most jobs over the past year with Health Care adding +404,000 jobs.

- With gains in nonresidential specialty trade contractors and in heavy and civil engineering, Construction has added 33,000 jobs. For the year, the sector has added 22,000 jobs.

- Manufacturing sector employment (+4,000) changed little for the third month in a row. In the 12 months prior to February 2019 the industry added on average 22,000 jobs per month.

- Average hourly earnings rose by 6 cents to $27.77. In April, average workweek for all employees decreased by 0.1 hour to 34.4 hours matching the rate for February 2019.

- The number of persons employed part-time held was unchanged at 4.7 million in April. The number of long-termed unemployed (greater than 27 weeks) remained unchanged at 1.2 million and remained to account for 21.1 percent of all unemployed.

- The following sectors saw little or no change in employment: Mining, Wholesale Trade, Transportation and Warehousing, Information, Leisure and Hospitality, and Government.

ANALYSIS

This month’s report is a rebounding blockbuster, considering two months ago the U.S. stock market and policy makers were stunned by the creation of only 56,000 jobs. (The original number was 33,000).

Wall Street estimated the April payrolls number at 185,000 jobs. Earlier in the week, the ADP National Employment Report, estimated the creation of 275,000 new private sector jobs; the BLS reported private sector job creation at 236,000 jobs.

Retail trade changed little in April; the sector was down 12,000 jobs but the motor vehicle and parts dealers subsector added 8,000 jobs. General merchandise stores suffered a loss of 9,000 jobs.

Revisions to previous reports were mixed. The February payrolls number was revised upward to 56,000 from 33,000 and the March number was revised down from 196,000 to 189,000. Still the revisions identified 16,000 more jobs than previously reported. The three-month moving average settled at 169,000 per month. Similar revisions from the earlier three months resulted in a three-month average of 180,000.

The unemployment rate of 3.6 percent is the lowest since 1969.

The current economy, based on supply-side reforms, is benefiting workers and instilling confidence in consumers. Not so long ago, market watchers were worried about the slowdown in consumer spending as a bellwether of an almost certain downturn.

On Thursday, the BLS reported than nonfarm business sector labor productivity increased 3.6 percent in the first quarter of 2019, with output increasing by 4.1 percent and hours worked increased 0.5 percent. Along with productivity (another blow-out number), the job market is at a sweet spot.

Today’s report noted that average hourly earnings over the past year have increased by 3.2 percent. Workers and consumers are more careful about how they treat homeowner equity which is 16 percent higher than 2006, the advent of the Great Recession. Apparently increased wages serve as a bulwark against reckless home equity borrowing.

As a result, workers are saving more. The article to read is “Why Are Americans Suddenly Saving?” by Matthew C. Klein in Barron’s on April 22, 2019.

Source: Author’s calculations based on BLS and US Census historical data (Total Retail Sales)

Conte Consulting: Editorial Services | Web Content Design & Management |Public Policy Analysis

Thursday, April 11, 2019

Friday, October 5, 2018

U.S. Employment Situation: 3.7% unemployment rate with 134,000 new payrolls

OVERVIEW

ANALYSIS

Total nonfarm payroll employment rose by 134,000 in September well below the 12-month average of 201,000. Wall Street expected a payroll increase by 185,000 jobs. The BLS reported 121,000 new private sector jobs were created compared with the ADP payrolls report released earlier this week of 230,000 private payrolls.

While jobs created were below expectations, the BLS revised numbers for July (from 147,000 to 165,000) and August from 201,000 to 270.000). After revisions, the BLS found the three-month average for new jobs arrived at 190,000 per month. Manufacturing continues to improve. Over the past year the sector has added 278,000 jobs — four-fifths of that growth taking place in the high-wage durable goods sector.

That could continue to improve as the nation’s manufacturing system continues to express optimism despite a worker shortage. According to the National Association of Manufacturers, “Nearly 93 percent of manufacturers are projecting further expansion for their businesses, and positive sentiment among smaller companies is up to 91.3 percent.”

In one of the only downsides of today’s report, Hurricane Florence may have caused some weakness in the Leisure and hospitality sector (-17,000).

Hispanic unemployment is at an all-time low.

Unemployment drifted downward for all groups by educational attainment (See chart below). "The labor market is in excellent shape heading into the end of 2018, perhaps the best it has been in 50 years," Gus Faucher, chief economist at PNC told CNBC. "Job growth was a bit softer in September, but some of that was from Hurricane Florence, and it should bounce back through the rest of 2018 and into 2019."

- The unemployment rate dropped to 3.7 percent in September with payrolls expanding by 134,000 jobs, according to the Bureau of Labor Statistics. The unemployment rate is the lowest since 1969.

- The Labor Force Participation (LFP) remained at 62.7 percent. The Employment-population ratio finished for the month at 60.4 percent, little changed. The number of unemployed for the month was 6.0 million, declining by 270,000.

- The economy added 137,000 jobs in September. Job gains took place in Professional and business services (+54,000), Health care (+26,000) and the Transportation and warehousing sector (+24,000).

- In addition, Construction added 23,000 jobs while Manufacturing added 18,000 jobs.

- According to the BLS, the following sectors saw little or no change in employment: Wholesale trade, Retail trade, Information, Financial activities and Government.

- Over the year, average hourly earnings have increased by 73 cents or 2.8 percent. In September the average hourly private nonfarm wage rang in at $27.24, an increase of eight cents. The average workweek for all employees was unchanged at 34.5 hours.

- Despite Hurricane Florence, the BLS said its surveys were within normal ranges. Major analysts appeared to agree.

- The number of persons employed part-time for economic reasons increased by 263,000 to 4.6 million. The number of long-term unemployed was little changed at 1.4 million. This group represents 22.9 of all unemployed persons.

ANALYSIS

Total nonfarm payroll employment rose by 134,000 in September well below the 12-month average of 201,000. Wall Street expected a payroll increase by 185,000 jobs. The BLS reported 121,000 new private sector jobs were created compared with the ADP payrolls report released earlier this week of 230,000 private payrolls.

While jobs created were below expectations, the BLS revised numbers for July (from 147,000 to 165,000) and August from 201,000 to 270.000). After revisions, the BLS found the three-month average for new jobs arrived at 190,000 per month. Manufacturing continues to improve. Over the past year the sector has added 278,000 jobs — four-fifths of that growth taking place in the high-wage durable goods sector.

That could continue to improve as the nation’s manufacturing system continues to express optimism despite a worker shortage. According to the National Association of Manufacturers, “Nearly 93 percent of manufacturers are projecting further expansion for their businesses, and positive sentiment among smaller companies is up to 91.3 percent.”

In one of the only downsides of today’s report, Hurricane Florence may have caused some weakness in the Leisure and hospitality sector (-17,000).

Hispanic unemployment is at an all-time low.

Unemployment drifted downward for all groups by educational attainment (See chart below). "The labor market is in excellent shape heading into the end of 2018, perhaps the best it has been in 50 years," Gus Faucher, chief economist at PNC told CNBC. "Job growth was a bit softer in September, but some of that was from Hurricane Florence, and it should bounce back through the rest of 2018 and into 2019."

|

| Chart by East Boston Economics - BLS,Table A4 - Educational Attainment |

Monday, September 24, 2018

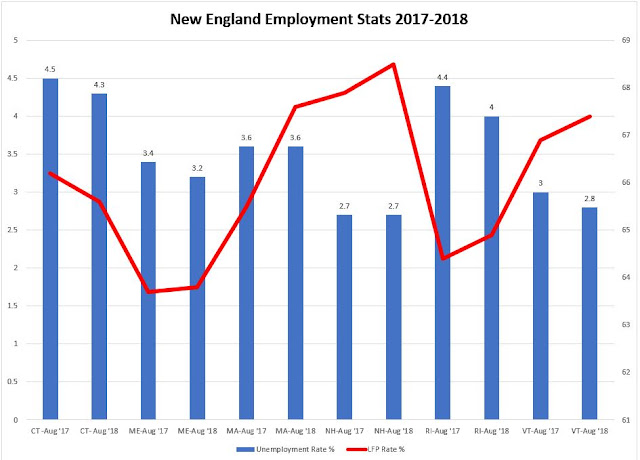

Comments on the MA Employment Situation for August 2018: U-Rate: 3.6%; Jobs: +6,100 jobs; +68,100 YoY

OVERVIEW

- The state’s unemployment rate remained at 3.6 percent in August according to the federal Bureau of Labor Statistics.

- Over the last 12 months, Massachusetts added 68,100 jobs.

- The Labor Force Participation rate increased three-tenths of a percentage point to 67.6 percent.

- The state’s labor force population stands at 3.806 million. Since August 2017, the LFP rate is up 2.1 percentage points.

- The largest private sector job gains took place in the Education and Health Services (+2,500) the Leisure and Hospitality (+1,700), Professional, Scientific and Business Services (+1,500), Information (+900) and Construction (+500).

- Manufacturing and Trade, Transportation and Utilities each lost 600 jobs. Other Services lost 100 while Government added 100 jobs; over the past year this sector lost 500 jobs.

ANALYSIS

The August unemployment rate in Massachusetts again was three-tenths of a percentage point lower than the national rate of 3.9 percent.

"The August estimates indicate the Commonwealth’s labor force and employment are at their highest levels while our unemployment rate remains consistently low - all indicators of the continuing positive economic outlook for the Commonwealth of Massachusetts." Labor and Workforce Development Secretary Rosalin Acosta said last Friday.

Massachusetts is the locomotive pulling New England states. New Hampshire was the only other New England with a statistically significant change from last August. Maine, along with New Hampshire and Vermont were the NE states with unemployment rates significantly different than the U.S. rate. Only one state, Connecticut saw a downturn in its LFP rate from 66.2 to 65.6 percent.

Year to date, all NE states are near the November 2017 estimates for 2018 by the New England Economic Partnership. (MA: 3.7; ME: 3.3; RI: 4.0; VT:3.0; NH 2.5 and CT: 48.)

Friday, September 7, 2018

U.S. Employment Situation August 2018: U-Rate: 3.9%; Jobs: +201,000

OVERVIEW

Job growth continued into August with 201,000 payroll jobs added. The consensus estimate centered around 191,000, according to CNBC.

Employment growth in August fell in line with the average monthly growth of 196,000 for the past 12 months.

The BLS reported that 204,000 private sector jobs were created during the month. Earlier in the week, ADP reported an increase of 163,000 nonfarm private sector jobs for August. Hindsight took some —but not much— enthusiasm out of previous two monthly payrolls reports. The BLS revised the payroll number for June 2018 to 208,000 from 248,000 and did the same for July 2018 — revising that month’s number to 147,000 from the 157,000 previously reported.

Examining five years of August data, economists expect the month’s numbers to be revised upward. The new numbers show the three-month average showed up at the rate of 185,000 jobs. The number of long-term unemployed (for more than 27 weeks or more) was little changed in August although over the past year the number had declined by 403,000. This group accounted for 21.5 percent of U.S. unemployment.

The energy sector, after a near two-year slump, generated 104,000 jobs “almost entirely in support activity for mining.”

Manufacturing is at a sweet spot, while employment changed little in this sector, employment was up by 254,000 with more than three fourths coming the durable goods segment.

The latest jobs and wages reports provide little ammunition for doves at the Federal Reserve Bank. There are no reasons to keep interest rates low. The Fed wanted to see growth in wages before hiking and its clear wages are moving in the right direction.

The economy is at a peak. Business confidence is up and supported by consumer optimism. “Today’s strong economy is finally translating into wage gains for more workers,” Andrew Chamberlain, chief economist of the labor-market research firm Glassdoor told MarketWatch.

- The unemployment rate remained 3.9 percent in August with payrolls expanding by 201,000 jobs, according to the Bureau of Labor Statistics.

- The Labor Force Participation (LFP) declined to 62.7 percent. The Employment-population ratio also declined in August by 0.2 to 60.3 percent. The number of unemployed for the month was 6.2 million, little changed from July.

- Among the major groups, the unemployment rate for adult men was 3.5 and 3.6 percent, respectively. Among minority groups, unemployment was 6.3 percent (Blacks), 3.0 percent (Asians) and 4.7 percent (Hispanics).

- In August, employment grew in the Wholesale trade, Health care, Professional services, Transportation and warehousing, and Mining.

- Professional and business services added 53,000 jobs.

- Wholesale trade added 22,000 jobs while Health care added 33,000. Wholesale trade benefited from the growth in durable good wholesale subsector while health care benefited from gains in the ambulatory and hospital subsectors.

- Manufacturing changed little in August.

- Month over month, employment in the other major sectors—Retail trade, Financial activities, Leisure and hospitality—changed little.

- Over the year, average hourly earnings have increased by 77 cents or 2.9 percent. In August the average hourly private nonfarm wage rang in at $27.16.

- The average workweek for all employees was unchanged at 34.5 hours.

- The number of persons employed part-time for economic reasons changed little over the month but was down by 830,000 over the year.

Job growth continued into August with 201,000 payroll jobs added. The consensus estimate centered around 191,000, according to CNBC.

Employment growth in August fell in line with the average monthly growth of 196,000 for the past 12 months.

The BLS reported that 204,000 private sector jobs were created during the month. Earlier in the week, ADP reported an increase of 163,000 nonfarm private sector jobs for August. Hindsight took some —but not much— enthusiasm out of previous two monthly payrolls reports. The BLS revised the payroll number for June 2018 to 208,000 from 248,000 and did the same for July 2018 — revising that month’s number to 147,000 from the 157,000 previously reported.

Examining five years of August data, economists expect the month’s numbers to be revised upward. The new numbers show the three-month average showed up at the rate of 185,000 jobs. The number of long-term unemployed (for more than 27 weeks or more) was little changed in August although over the past year the number had declined by 403,000. This group accounted for 21.5 percent of U.S. unemployment.

The energy sector, after a near two-year slump, generated 104,000 jobs “almost entirely in support activity for mining.”

Manufacturing is at a sweet spot, while employment changed little in this sector, employment was up by 254,000 with more than three fourths coming the durable goods segment.

The latest jobs and wages reports provide little ammunition for doves at the Federal Reserve Bank. There are no reasons to keep interest rates low. The Fed wanted to see growth in wages before hiking and its clear wages are moving in the right direction.

The economy is at a peak. Business confidence is up and supported by consumer optimism. “Today’s strong economy is finally translating into wage gains for more workers,” Andrew Chamberlain, chief economist of the labor-market research firm Glassdoor told MarketWatch.

Friday, July 6, 2018

June 2018 Employment Situation: U-Rate: 4.0%; Jobs: +213,000

OVERVIEW

ANALYSIS

The U.S. economy added 213,000 jobs beating economists’ expectations in the range of 200,000 and 195,000 jobs.

The report looks even better when considering the revisions. April’s report was revised upward to 175,000 jobs from the previously reported 159,000 and May’s report was revised upward to 244,000 from 223,000. The BLS reported that after these revisions, job gains have averaged 211,000 per month over the last three months.

The private sector created 202,000 new jobs, a figure higher than this week’s ADP report for the same month (+177,000).

The unemployment rate rose to 4.0 percent from 3.8 percent but remains lower than 12 month ago (4.3 percent). The increase may be attributable to the 0.2 percentage point increase in labor force participation over the past month.

Over the past year the manufacturing sector has added 285,000 jobs, an impressive number that will be tested as trade disputes intensify with new tariffs on foreign goods.

Average hourly earnings for all employees rose by five cents to $26.98, representing a gain of 2.7 percent over the past year. The average work week remained at 34.5 hours.

The number of long-term unemployment increased by 289,000 to 1.5 million. These individuals who have been unemployed for more than 27 weeks account for 23 percent of all unemployed. The percent distribution of this group has increased over the past five months suggesting the hardships of returning to work after long periods of unemployment.

- The unemployment rate rose to 4.0 percent in June with payrolls expanding by 213,000 jobs, according to the Bureau of Labor Statistics.

- The Labor Force Participation (LFP) edged up by 0.2 percentage point to 62.9 percent. The employment-population ratio was unchanged in June at 60.4 percent and has remained flat since February. The number of unemployed for the month of June was 6.6 million. One year ago, that number was 7.0 million.

- In June employment grew in the manufacturing, health care, construction and mining sectors.

- Manufacturing added 36,000 jobs with durable goods manufacturing accounting for most of the increase.

- Professional and business services added 50,000 jobs. This sector has added 521,000 jobs over the past year. Retail lost 22,000 jobs in June offsetting May’s gain of 25,000 jobs.

- Employment in the other major sectors—wholesale trade, transportation and warehousing, information, financial activities, leisure and hospitality and government —changed little over the month.

- The average duration of unemployment declined over the past year from 24.9 to 21.2 weeks.

ANALYSIS

The U.S. economy added 213,000 jobs beating economists’ expectations in the range of 200,000 and 195,000 jobs.

The report looks even better when considering the revisions. April’s report was revised upward to 175,000 jobs from the previously reported 159,000 and May’s report was revised upward to 244,000 from 223,000. The BLS reported that after these revisions, job gains have averaged 211,000 per month over the last three months.

The private sector created 202,000 new jobs, a figure higher than this week’s ADP report for the same month (+177,000).

The unemployment rate rose to 4.0 percent from 3.8 percent but remains lower than 12 month ago (4.3 percent). The increase may be attributable to the 0.2 percentage point increase in labor force participation over the past month.

Over the past year the manufacturing sector has added 285,000 jobs, an impressive number that will be tested as trade disputes intensify with new tariffs on foreign goods.

Average hourly earnings for all employees rose by five cents to $26.98, representing a gain of 2.7 percent over the past year. The average work week remained at 34.5 hours.

The number of long-term unemployment increased by 289,000 to 1.5 million. These individuals who have been unemployed for more than 27 weeks account for 23 percent of all unemployed. The percent distribution of this group has increased over the past five months suggesting the hardships of returning to work after long periods of unemployment.

Monday, March 26, 2018

New NBER Working Paper: U.S. Employment and Opioids: Is There a Connection?

From a new NBER Working Paper "U.S. Employment and Opioids: Is There a Connection?" by Janet Currie, Jonas Y. Jin and Molly Schnell.

Abstract:

This paper uses quarterly county-level data to examine the relationship between opioid prescription rates and employment-to-population ratios from 2006-2014. We first estimate models of the effect of opioid prescription rates on employment-to-population ratios, instrumenting opioid prescriptions for younger ages using opioid prescriptions to the elderly. We also estimate models of the effect of employment-to-population ratios on opioid prescription rates using a shift-share instrument. We find that the estimated effect of opioids on employment-to-population ratios is positive but small for women, but there is no relationship for men. These findings suggest that although they are addictive and dangerous, opioids may allow some women to work who would otherwise leave the labor force. When we examine the effect of employment-to-population ratios on opioid prescriptions, our results are more ambiguous. Overall, our findings suggest that there is no simple causal relationship between economic conditions and the abuse of opioids. Therefore, while improving economic conditions in depressed areas is desirable for many reasons, it is unlikely to curb the opioid epidemic.

The working paper is available here, (gated).

Friday, February 2, 2018

Notes on today's U.S. payrolls number and unemployment rate: +200,000 jobs; 4.1 percent

OVERVIEW

- The unemployment rate remained at 4.1 percent for the fourth consecutive month in December while payrolls expanded by 200,000, according to the Bureau of Labor Statistics.

- The Labor Force Participation (LFP) remained at also remained at 62.7 percent for the fourth straight month. The employment-population ratio was unchanged at 60.1 percent for the third straight month.

- Construction added 36,000 jobs in January.

- Employment in food services and drinking places added 31,000 jobs while employment in health care added 21,000 with 13,000 of those jobs in hospitals.

- The manufacturing sector added 15,000 jobs continuing a trend. In the past 12 months, the sector has added 186,000 jobs.

- Employment in the other major sectors— mining, wholesale trade, retail trade, transportation and warehousing, information, financial activities, professional services and government —changed little over the month.

- The November 2017 number was revised downward from 252, 000 to 216,000 and the December 2017 payrolls number was revised up from 148,000 to 160,000.

ANALYSIS

After a disappointing December print, the labor market picked up in January. After revisions to earlier reports, job gains averaged 192,000 months for the past three months. A survey of Wall Street Journal economists expected an increase of 177,000 jobs. According to an ADP report earlier this week, private sector employment increased by 234,000 jobs in January. Also, this past week saw a Labor Department report showing that initial claims for state unemployment benefits slipped 1,000 to a seasonally adjusted 230,000 for the last week of the month. According to Reuters this represents the 152nd week of claims settling below the 300,000 threshold associated with a strong economy. Wage growth underscores the tight labor markets. This wage growth is the fastest since the Great Recession. However, the labor force participation rate remains low by historical standards; the rate only declined by one-tenth of a percentage point since last January. In addition, the broader measure which includes discouraged workers, the U-6 rate increased to 8.2 percent. The decline in African-American workers proved to be a bump. After falling to 6.8 percent in December, the rate for black workers rose to 7.7 percent last month. Despite the recent wage increases overall, the lower-wage food services and drinking places sector grew faster than higher wages sectors such as professional and technical services over the past 10 years. (See chart below.)

Friday, January 5, 2018

Manufacturing says "See you in December": BLS: NFP +148,000 U-Rate 4.1%

OVERVIEW

- The unemployment rate remained at 4.1 percent for the third consecutive month in December while payrolls expanded by 148,000, according to the Bureau of Labor Statistics.

- The Labor Force Participation (LFP) remained at 62.7 percent. The employment-population ratio was unchanged at 60.1 percent.

- Employment in health care increased by 31,000 while construction added 36,000 jobs.

- The manufacturing sector added 25,000 jobs. The BLS reports that this sector added 196,000 jobs in 2017 after a dismal 2016 which saw a loss of 16,000 jobs.

- Professional and business services kept pace in 2017 with the previous year adding 44,000 jobs per month. In December, the sector added 19,000 jobs

- Employment in the other major sectors— mining, wholesale trade, transportation and warehousing, information, financial activities and government —changed little over the month.

- Over the year, the BLS reports the unemployment rate and the number of unemployed were down by 0.6 percentage point and 926,000, respectively.

ANALYSIS

In December, the American jobs machine took a breather. The payroll employment (+148,000) fell below the Wall Street consensus of 190,000 jobs. According to an ADP report earlier this week, private sector employment increased by 250,000 jobs in December. The unemployment rate for the major work groups remained low. The unemployment rate for African-Americans fell to 6.8 percent the lowest ever. The retail sector fared better under the last year of the previous administration where it increased by 203,000 in 2016. In 2017 it lost 67,000. Employment in general merchandise edged down in 2017 shedding 67,000 jobs. However, Manufacturing added 196,000 jobs in 2017 following little net change in 2016. The November employment report was revised up from +228,000 to +252,000 and the change in October was revised down from +244,000 to +211,000 (Combined over two months, a net loss of 9,000 jobs). Over the past three months, job gains have averaged 204,000 a month. In December, average hourly earnings for all employees increased by 9 cents to $26.63; over the past year, hourly earnings have risen by 65 cents or 2.5 percent. The labor force participation rate has not changed over the year. It remains at 62.7 percent. The number of workers employed part-time for economic reasons has declined by 639,000 over the past year.

Friday, June 2, 2017

Quick take on today's jobs numbers: U-Rate: 4.3%; Jobs: +138,000

OVERVIEW

• The unemployment rate declined to 4.3 percent in March while payrolls expanded by 138,000, according to the Bureau of Labor Statistics.

• The Labor Force Participation (LFP) rate declined by 0.2 percentage point to 62.7 percent for May. The employment-population ratio also declined by 0.2 percentage point to 60.0 percent.

• Employment rose in mining and health care, +7,000 and +24,000 respectively.

• Employment in the other major sectors— construction, manufacturing, wholesale trade, retail trade, transportation and warehousing, information, financial activities and government —were unchanged.

• In May, average hourly earnings for all employees increased by 4 cents to $26.22, representing a 2.5 percent year over year increase.

• In May, employment in the professional services sector remains strong keeping up with the average gains for 2016.

• The March employment situation report was revised down further to 50,000 from 79,000 originally reported. April’s increase in jobs was also revised downward from 211,000 to 174,000. Over the past three months, job gains averaged 121,000.

• The average workweek for all employees was unchanged at 34.4 hours.

ANALYSIS

The payroll employment report fell well below Wall Street consensus of 180,000 jobs and below the 12-month average of 181,000. The BLS private sector employment reported 123,831 private sector jobs. According to an ADP report earlier this week, private sector employment increased by 253,000 jobs from April to March. The number of persons employed part-time (but who would like more hours), was little changed at 5.2 million suggesting the growing jobs market isn’t matching worker needs. Employment in mining, (which covers the oil and gas extraction industries) has increased by 47,000 since October 2016. Employment in food and drinking places also continued to move upward. In the last 12 months, this sector has added 267,000 jobs. The battered retail sector appeared to stem previous losses; job payrolls showed little change since April. The heavily government-funded health care sector continued to grow with hospitals adding 7,000 jobs. However current year to date average monthly growth is down at 22,000 per month compared to 32,000 for 2016. "This report is clearly soft in every material respect relative to expectations and relative to last month. That's a disappointment," said Eric Winograd, U.S. economist at Alliance Bernstein. However, he added, "I don't think it's soft enough to cause a fundamental rethink of the economic outlook." Economists will now wait for the Federal Reserve Bank to weigh the new payrolls number as it adjusts monetary policy.

• The unemployment rate declined to 4.3 percent in March while payrolls expanded by 138,000, according to the Bureau of Labor Statistics.

• The Labor Force Participation (LFP) rate declined by 0.2 percentage point to 62.7 percent for May. The employment-population ratio also declined by 0.2 percentage point to 60.0 percent.

• Employment rose in mining and health care, +7,000 and +24,000 respectively.

• Employment in the other major sectors— construction, manufacturing, wholesale trade, retail trade, transportation and warehousing, information, financial activities and government —were unchanged.

• In May, average hourly earnings for all employees increased by 4 cents to $26.22, representing a 2.5 percent year over year increase.

• In May, employment in the professional services sector remains strong keeping up with the average gains for 2016.

• The March employment situation report was revised down further to 50,000 from 79,000 originally reported. April’s increase in jobs was also revised downward from 211,000 to 174,000. Over the past three months, job gains averaged 121,000.

• The average workweek for all employees was unchanged at 34.4 hours.

ANALYSIS

The payroll employment report fell well below Wall Street consensus of 180,000 jobs and below the 12-month average of 181,000. The BLS private sector employment reported 123,831 private sector jobs. According to an ADP report earlier this week, private sector employment increased by 253,000 jobs from April to March. The number of persons employed part-time (but who would like more hours), was little changed at 5.2 million suggesting the growing jobs market isn’t matching worker needs. Employment in mining, (which covers the oil and gas extraction industries) has increased by 47,000 since October 2016. Employment in food and drinking places also continued to move upward. In the last 12 months, this sector has added 267,000 jobs. The battered retail sector appeared to stem previous losses; job payrolls showed little change since April. The heavily government-funded health care sector continued to grow with hospitals adding 7,000 jobs. However current year to date average monthly growth is down at 22,000 per month compared to 32,000 for 2016. "This report is clearly soft in every material respect relative to expectations and relative to last month. That's a disappointment," said Eric Winograd, U.S. economist at Alliance Bernstein. However, he added, "I don't think it's soft enough to cause a fundamental rethink of the economic outlook." Economists will now wait for the Federal Reserve Bank to weigh the new payrolls number as it adjusts monetary policy.

The nation's health care sector grows even during recessions.

Subscribe to:

Posts (Atom)

Indicators

Test