This just in from the Executive Office of Labor and Workforce Development:

BOSTON, MA (March 13, 2020)– The state’s January total unemployment remained unchanged at 2.8 percent for the sixth consecutive month following on the Bureau of Labor Statistics’ annual revisions, the Executive Office of Labor and Workforce Development announced Friday.

The Bureau of Labor Statistics’ preliminary job estimates indicate Massachusetts added 11,800 jobs in January. Over the month, the private sector added 11,100 jobs as gains occurred in Trade, Transportation, and Utilities; Education and Health Services; Professional, Scientific, and Business Services; Financial Activities; Leisure and Hospitality; Other Services; Information; Construction; and Manufacturing.

From January 2019 to January 2020, BLS estimates Massachusetts added 33,400 jobs.

The January unemployment rate was eight-tenths of a percentage point lower than the national rate of 3.6 percent reported by the Bureau of Labor Statistics.

"Following year-end revisions, BLS now estimates Massachusetts added 33,400 jobs over the year. In addition to those job gains, the labor force increased by 27,000 from last year’s level, with 39,400 more residents employed and 12,300 fewer residents unemployed," Labor and Workforce Development Secretary Rosalin Acosta said.

The labor force increased by 1,900 from 3,834,300 in December, as 2,300 more residents were employed and 400 fewer residents were unemployed over the month.

Over the year, the state’s seasonally adjusted unemployment rate dropped three-tenths of a percentage point.

The state’s labor force participation rate – the total number of residents 16 or older who worked or were unemployed and actively sought work in the last four weeks – remained unchanged at 67.9 percent. Compared to January 2019, the labor force participation rate is up two-tenths of a percentage point.

The largest private sector percentage job gains over the year were in Information; Education and Health Services; Professional, Scientific, and Business Services; and Construction.

Annual revisions to the job estimates show growth was greater than previously published for 2018 and less in 2019. In 2018, 42,700 jobs were added over the year. In 2019, estimates indicate 26,100 jobs were added over the year. BLS annually updates job estimates for each state with the most up-to-date information supplied by employers.

Annual year-end revisions show the unemployment rates were slightly lower than the previously published estimates for August 2019 through November 2019. The labor force estimates were lower than previously published estimates for 2015 to 2019.

January 2020 Employment Overview

Trade, Transportation and Utilities added 3,400 (+0.6%) jobs over the month. Over the year, Trade, Transportation and Utilities gained 2,900 (+0.5%) jobs.

Education and Health Services added 2,000 (+0.2%) jobs over the month. Over the year, Education and Health Services gained 11,700 (+1.4%) jobs.

Professional, Scientific and Business Services added 1,600 (+0.3%) jobs over the month. Over the year, Professional, Scientific and Business Services gained 7,000 (+1.2%) jobs.

Financial Activities added 1,100 (+0.5%) jobs over the month. Over the year, Financial Activities gained 1,300 (+0.6%) jobs.

Leisure and Hospitality added 800 (+0.2%) jobs over the month. Over the year, Leisure and Hospitality gained 2,100 (+0.6%).

Other Services added 800 (+0.6%) jobs over the month. Over the year, Other Services are up 100 (+0.1%) jobs.

Information added 600 (+0.6%) jobs over the month. Over the year, Information gained 3,600 (+3.9%) jobs.

Construction added 500 (+0.3%) jobs over the month. Over the year, Construction has added 1,000 (+0.6%) jobs.

Manufacturing added 300 (+0.1%) jobs over the month. Over the year, Manufacturing lost 1,500 (-0.6%) jobs.

Government added 700 (+0.2%) jobs over the month. Over the year, Government gained 5,200 (+1.1%) jobs.

Labor Force Overview

The January estimates show 3,729,900 Massachusetts residents were employed and 106,200 were unemployed, for a total labor force of 3,836,100. The unemployment rate remained steady at 2.8 percent. The January labor force increased by 1,900 from 3,834,300 in December, as 2,300 more residents were employed and 400 fewer residents were unemployed over the month. The labor force participation rate, the share of working age population employed and unemployed, remained unchanged at 67.9 percent. The labor force was up 27,000 from the 3,809,100 January 2019 estimate, with 39,400 more residents employed and 12,300 fewer residents unemployed.

Detailed labor market information is available at www.mass.gov/lmi.

Showing posts with label Unemployment rate. Show all posts

Showing posts with label Unemployment rate. Show all posts

Friday, March 13, 2020

Friday, July 5, 2019

Notes on the U.S. Employment Situation for June 2019: U-rate 3.7%, Jobs +224,000

OVERVIEW

ANALYSIS

After a weak May payrolls report (+72,000) the U.S. jobs machine roared back with 224,000 new jobs in June.

Professional and Business Services, Health Care and Transportation and Warehousing sectors lead June’s growth.

Overall, the jobs machine is clearly slowing down. Employment growth, according to the BLS, has averaged 172,000 this calendar year compared with an average of 223,000 in 2018.

However, today’s BLS report shattered expectations; Wall Street expected a gain of 160,000 new jobs. While slower than one year ago, the private sector culled 191,000 new jobs. The parallel measure, the ADP National Employment Report, earlier this week projected a gain of 106,000 private jobs.

With the BLS revisions, the three-month average for U.S. job growth rang in at 171,000.

Despite uncertainty about international trade, the U.S. Manufacturing sector is holding its own. The Manufacturing sector added 17,000 jobs in June; while little changed over the past four months, manufacturing is growing albeit slowly. Thus far the sector has averaged 8,000 per month, compared with 22,000 last year.

The trade-tariff impasse is not diminishing growth in the sector. While the manufacturing sector employs approximately 120,000 less workers than it did before the Great Recession, average hourly wages are rising steadily. (See Figure A.)

Unemployment in the manufacturing sector declined from June 2018 to June 2019, from 3.1 percent to 2.8 percent. For most part, manufacturing attracts workers on the lower end of educational attainment, but wages are good entry point to the middle class. These workers have also fared well overall in the economy. Unemployment for those with less than a high school degree was 5.8 percent in May. Workers with a high school diploma and no college and some college faced unemployment rates of 3.9 percent and 3.0 percent, respectively.

- Total non-farm payroll employment increased by 224,000 and the unemployment rate rose to 3.7 percent, according to the Bureau of Labor Statistics.

- The Labor Force Participation (LFP) rate remained at 62.9 percent the same rate from one year ago. The Employment-Population ratio also remained at 60.6 percent.

- Professional and Business Services (+51,000) and Health Care (+35,000) led all sectors in May. Construction added 21,000 jobs. Manufacturing added 17,000 jobs.

- Employment in other industries did not change from May to June. Mining, Wholesale Trade, Retail Trade, Information, Financial Activities, Leisure and Hospitality and Government changed little.

- Average hourly earnings rose by 6 cents to $27.90. Since June 2018 wages are up 3.1 percent.

- In June, the average workweek for all employees remained at 34.4 hours.

- The number of persons employed part-time was unchanged in June (4.3 million). The number of long-termed unemployed (greater than 27 weeks) remained unchanged at 1.4 million and accounted for 23.7 percent of all unemployed.

- In June 1.6 million persons were not in the workforce but wanted and were available for work and sought employment in the last year. This group known as “workers marginally attached to the labor force” was unchanged since last year. BLS reports that 1.1 million of this group had not searched for work “for reasons such as school attendance or family responsibilities.”

- Revisions to the two previous months counted 11,000 less jobs than reported initially. April 2019 was revised from 224,000 to 216,000 while May 2019 was revised from 75,000 to 72,000.

ANALYSIS

After a weak May payrolls report (+72,000) the U.S. jobs machine roared back with 224,000 new jobs in June.

Professional and Business Services, Health Care and Transportation and Warehousing sectors lead June’s growth.

Overall, the jobs machine is clearly slowing down. Employment growth, according to the BLS, has averaged 172,000 this calendar year compared with an average of 223,000 in 2018.

However, today’s BLS report shattered expectations; Wall Street expected a gain of 160,000 new jobs. While slower than one year ago, the private sector culled 191,000 new jobs. The parallel measure, the ADP National Employment Report, earlier this week projected a gain of 106,000 private jobs.

With the BLS revisions, the three-month average for U.S. job growth rang in at 171,000.

Despite uncertainty about international trade, the U.S. Manufacturing sector is holding its own. The Manufacturing sector added 17,000 jobs in June; while little changed over the past four months, manufacturing is growing albeit slowly. Thus far the sector has averaged 8,000 per month, compared with 22,000 last year.

The trade-tariff impasse is not diminishing growth in the sector. While the manufacturing sector employs approximately 120,000 less workers than it did before the Great Recession, average hourly wages are rising steadily. (See Figure A.)

Unemployment in the manufacturing sector declined from June 2018 to June 2019, from 3.1 percent to 2.8 percent. For most part, manufacturing attracts workers on the lower end of educational attainment, but wages are good entry point to the middle class. These workers have also fared well overall in the economy. Unemployment for those with less than a high school degree was 5.8 percent in May. Workers with a high school diploma and no college and some college faced unemployment rates of 3.9 percent and 3.0 percent, respectively.

|

| Figure A: Employment and Average Hourly Wages in the U.S. Manufacturing Sector |

Friday, May 3, 2019

Note on the April 2019 U.S. Employment Situation: U-Rate 3.6%; Jobs +263,000

OVERVIEW

ANALYSIS

This month’s report is a rebounding blockbuster, considering two months ago the U.S. stock market and policy makers were stunned by the creation of only 56,000 jobs. (The original number was 33,000).

Wall Street estimated the April payrolls number at 185,000 jobs. Earlier in the week, the ADP National Employment Report, estimated the creation of 275,000 new private sector jobs; the BLS reported private sector job creation at 236,000 jobs.

Retail trade changed little in April; the sector was down 12,000 jobs but the motor vehicle and parts dealers subsector added 8,000 jobs. General merchandise stores suffered a loss of 9,000 jobs.

Revisions to previous reports were mixed. The February payrolls number was revised upward to 56,000 from 33,000 and the March number was revised down from 196,000 to 189,000. Still the revisions identified 16,000 more jobs than previously reported. The three-month moving average settled at 169,000 per month. Similar revisions from the earlier three months resulted in a three-month average of 180,000.

The unemployment rate of 3.6 percent is the lowest since 1969.

The current economy, based on supply-side reforms, is benefiting workers and instilling confidence in consumers. Not so long ago, market watchers were worried about the slowdown in consumer spending as a bellwether of an almost certain downturn.

On Thursday, the BLS reported than nonfarm business sector labor productivity increased 3.6 percent in the first quarter of 2019, with output increasing by 4.1 percent and hours worked increased 0.5 percent. Along with productivity (another blow-out number), the job market is at a sweet spot.

Today’s report noted that average hourly earnings over the past year have increased by 3.2 percent. Workers and consumers are more careful about how they treat homeowner equity which is 16 percent higher than 2006, the advent of the Great Recession. Apparently increased wages serve as a bulwark against reckless home equity borrowing.

As a result, workers are saving more. The article to read is “Why Are Americans Suddenly Saving?” by Matthew C. Klein in Barron’s on April 22, 2019.

Source: Author’s calculations based on BLS and US Census historical data (Total Retail Sales)

Conte Consulting: Editorial Services | Web Content Design & Management |Public Policy Analysis

- Total non-farm payroll employment increased by 263,000 and the unemployment rate declined to 3.6 percent, moving down 0.2 percentage point from the previous month according to the Bureau of Labor Statistics.

- The Labor Force Participation (LFP) rate declined by 0.2 percentage point to 62.8 percent. Nonetheless, the rate was unchanged from a year ago. The Employment-Population ratio also remained at 60.6 percent. Since October 2018, the rate has been either 60.6 percent or 60.7 percent.

- Professional and Business Services (+76,000) and Construction (+33,000) led all sectors in the April payrolls. Employment in Health Care (+27,000) did not finish in the top two sectors for growth but along with Professional Services (+535,000) added the most jobs over the past year with Health Care adding +404,000 jobs.

- With gains in nonresidential specialty trade contractors and in heavy and civil engineering, Construction has added 33,000 jobs. For the year, the sector has added 22,000 jobs.

- Manufacturing sector employment (+4,000) changed little for the third month in a row. In the 12 months prior to February 2019 the industry added on average 22,000 jobs per month.

- Average hourly earnings rose by 6 cents to $27.77. In April, average workweek for all employees decreased by 0.1 hour to 34.4 hours matching the rate for February 2019.

- The number of persons employed part-time held was unchanged at 4.7 million in April. The number of long-termed unemployed (greater than 27 weeks) remained unchanged at 1.2 million and remained to account for 21.1 percent of all unemployed.

- The following sectors saw little or no change in employment: Mining, Wholesale Trade, Transportation and Warehousing, Information, Leisure and Hospitality, and Government.

ANALYSIS

This month’s report is a rebounding blockbuster, considering two months ago the U.S. stock market and policy makers were stunned by the creation of only 56,000 jobs. (The original number was 33,000).

Wall Street estimated the April payrolls number at 185,000 jobs. Earlier in the week, the ADP National Employment Report, estimated the creation of 275,000 new private sector jobs; the BLS reported private sector job creation at 236,000 jobs.

Retail trade changed little in April; the sector was down 12,000 jobs but the motor vehicle and parts dealers subsector added 8,000 jobs. General merchandise stores suffered a loss of 9,000 jobs.

Revisions to previous reports were mixed. The February payrolls number was revised upward to 56,000 from 33,000 and the March number was revised down from 196,000 to 189,000. Still the revisions identified 16,000 more jobs than previously reported. The three-month moving average settled at 169,000 per month. Similar revisions from the earlier three months resulted in a three-month average of 180,000.

The unemployment rate of 3.6 percent is the lowest since 1969.

The current economy, based on supply-side reforms, is benefiting workers and instilling confidence in consumers. Not so long ago, market watchers were worried about the slowdown in consumer spending as a bellwether of an almost certain downturn.

On Thursday, the BLS reported than nonfarm business sector labor productivity increased 3.6 percent in the first quarter of 2019, with output increasing by 4.1 percent and hours worked increased 0.5 percent. Along with productivity (another blow-out number), the job market is at a sweet spot.

Today’s report noted that average hourly earnings over the past year have increased by 3.2 percent. Workers and consumers are more careful about how they treat homeowner equity which is 16 percent higher than 2006, the advent of the Great Recession. Apparently increased wages serve as a bulwark against reckless home equity borrowing.

As a result, workers are saving more. The article to read is “Why Are Americans Suddenly Saving?” by Matthew C. Klein in Barron’s on April 22, 2019.

Source: Author’s calculations based on BLS and US Census historical data (Total Retail Sales)

Conte Consulting: Editorial Services | Web Content Design & Management |Public Policy Analysis

Friday, February 1, 2019

US EMPSIT: January 2019: U-Rate: 4.0%; Jobs: +304,000

OVERVIEW

- The unemployment rate rose slightly to 4.0 percent in January with payrolls expanding by 304,000 jobs, according to the Bureau of Labor Statistics.

- The Labor Force Participation (LFP) rate changed little at 63.2 percent. The Employment-Population ratio also remained at 60.7 percent. Both measures are up 0.5 percentage points over the year.

- Job gains took place in Leisure and Hospitality (+74,000) and Construction (+52,000) Health Care (+42,000) and Transportation and Warehousing (+27,000) In addition, Professional and Business Services added 30,000 jobs.

- According to the BLS, the following sectors saw little or no change in employment: Wholesale Trade, Information and Financial Activities.

- Over the year, average hourly earnings have increased by 85 cents or 3.2 percent. In January, the average hourly private nonfarm wage rang in at $27.56. The average workweek for all employees was unchanged at 34.5 hours.

- The number of persons employed part-time increased to 5.1 million in January, most of it coming from the private sector and due to the shutdown.

- The number of long-termed unemployed (greater than 27 weeks) remained unchanged at 1.3 million.

ANALYSIS

If anyone was looking for the federal government shutdown to pause the American jobs machine, they will have to look elsewhere. The economy entered its 100th straight month of increased employment.

According to the latest measurement, the shutdown had minimal impact on job creation with the payrolls number arriving at 304,000.

Wall Street economists expected a January print of approximately 170,000 jobs.

On Wednesday, ADP, the payroll processing company, reported an increase of 213,000 private sector jobs in January. Today, the BLS reported the economy created 296,000 private sector jobs. Both measures generally track together (See chart above).

According to the BLS, federal government employment was unchanged in January. The agency explained: “Federal employees on furlough during the partial government shutdown were counted as employed in the establishment survey because they worked or received pay (or will receive pay) for the pay period that included the 12th of the month.”

Revisions to the two previous months resulted in a decline of 70,000 jobs. The November 2018 number was revised up from +176,000 to +196,000. However, the December number was revised downward from +312,000 to +222,000.

The decline is explained by the BLS adjustment of its annual benchmarking process. Accounting for these revisions, the three-month average rang in at 241,000 per month.

Conte Consulting: Editorial Services | Web Content Design & Management |Public Policy Analysis

Wednesday, December 26, 2018

The November 2018 Employment Situation in Massachusetts

U-Rate: 3.4%; +4,600; +60,500 YoY

OVERVIEW- According to the Executive Office of Labor and Workforce Development, the state’s total unemployment rate dropped one-tenth of a percentage point to 3.4 percent in November.

- According to the federal Bureau of Labor Statistics, the state added 4,600 jobs in November.

- he state’s unemployment rate was three-tenths of a percentage point lower than the national average of 3.7 percent.

- The state’s Labor Force Participation Rate (LFP) remained at 68.0 percent. Since November 2017, the LFP rate by 2.7 percentage points.

- Trade, Transportation and Utilities added 3,100 over the month and Professional, Scientific and Business Services added 1,700 with Education and Health Services adding 1,200.

- Financial Activities lost 700 jobs over the month with Construction (-500), Other Services (-300) and Manufacturing (-100) also losing jobs in November.

- Two sectors remained unchanged over the month: Government and Leisure and Hospitality.

ANALYSIS

Since January the Massachusetts monthly unemployment rate averaged 3.5 percent. The state continues to enjoy an unemployment rate less than the national rate.

The jobs economy is driven mostly by the state’s Professional, Scientific and Business Services sector, which created 27,600 jobs since last November. However, the Leisure and Hospitality sector shed 800 jobs since that time. Financial Activities only added 700 jobs. Government has lost jobs.

Education and Health Services comprise the largest sector in Massachusetts. (See table above) Over the past 12 months it has added 14,400 jobs.

Assuming the BLS figure of 60,500 new jobs, the state created a monthly average of approximately 5,000 jobs since last November. Northern New England is benefiting from low unemployment rates.

PDF Version

Friday, November 2, 2018

Notes on today's U.S. jobs report: A 3.7% unemployment rate and 250,000 new jobs

OVERVIEW

- The unemployment rate remained at 3.7 percent in October with payrolls expanding by 250,000 jobs, according to the Bureau of Labor Statistics.

- According to the BLS, Hurricane Michael, which fell while the agency collected data, had no noticeable effect on job estimates.

- The Labor Force Participation (LFP) rose 0.02 to 62.9 percent. The Employment-population ratio also finished up for the month at 60.6 percent. The number of unemployed for the month was 6.1 million representing a decline over the year of 449,000 persons.

- Job gains took place in, Health care (+36,000), Manufacturing (+32,000), Construction (+30,000) Professional and business services (+35,000) and the Transportation and warehousing sector (+25,000).

- Mining grew by 5,000 jobs in October while Leisure and hospitality gained 42,000 withstanding the impact of Hurricane Florence. While employment was unchanged in this sector, the two-month growth matched the 12-month average at 21,000 per month.

- In addition, according to the BLS, the following sectors saw little or no change in employment: Wholesale trade, Retail trade, Information, Financial activities and Government.

- Over the year, average hourly earnings have increased by 83 cents or 3.1 percent. In October, the average hourly private non-farm wage rang in at $27.30, an increase of five cents. The average workweek for all employees clocked in at 34.5 hours.

- The number of persons employed part-time for economic reasons was unchanged at 4.6 million. The number of long-term unemployed also changed little at 1.4 million. This group represents 22.5 percent of all unemployed persons.

ANALYSIS

Total nonfarm payroll employment rose by 250,000 in October. Not knowing how to gauge weather interruptions from last month, Wall Street forecasts provided a wide range of payroll increases between 105.000 to 253,000 jobs.

The BLS revised numbers for September downward (from 134,000 to 118,000) and upward for August (from 270,000 to 286,000). These revised figures show that job gains have averaged 218,000 over the past three months.

The BLS reported 246,000 new private sector jobs were created compared with the ADP payrolls report released earlier this week of 227,000 private payrolls.

The continued growth in the manufacturing sector emerged as one of the highlights on today’s report. The sector has added 296,000 jobs over the past year— most of it coming from durable goods production. Here, in this sector, the workweek remained steady at 40.8 hours.

While the economy is at full employment, worker productivity is lagging. Output, the amount produced by workers, has been sluggish. At 1.3 percent in the most recent measure, productivity has failed to surpass 2 percent for the last 32 quarters. Nearly two decades ago, productivity gains fell regularly in the 3 percent range.

According to the Wall Street Journal, Chicago Fed President Charles Evans noted the importance of productivity to the nation’s long-term growth in speech earlier this year. “Higher sustainable growth would be great. However, we can’t get there without boosting the underlying trends in labor input or productivity,” Mr. Evans said.

Manufacturing sector labor productivity increased 0.5 percent in the third quarter, according the third quarter report released earlier this week. There’s some good news for workers: Average hourly earnings have recovered from the Great Recession but still below the 2008 pre-recession peak. Labor force participation, which has languished as a result of the retiring baby-boom workers inched up by 0.2 percentage point over the year. These two trends point to mounting pressures on the Federal Reserve Bank to stick to its plan to raise interest rates through 2019.

Friday, October 5, 2018

U.S. Employment Situation: 3.7% unemployment rate with 134,000 new payrolls

OVERVIEW

ANALYSIS

Total nonfarm payroll employment rose by 134,000 in September well below the 12-month average of 201,000. Wall Street expected a payroll increase by 185,000 jobs. The BLS reported 121,000 new private sector jobs were created compared with the ADP payrolls report released earlier this week of 230,000 private payrolls.

While jobs created were below expectations, the BLS revised numbers for July (from 147,000 to 165,000) and August from 201,000 to 270.000). After revisions, the BLS found the three-month average for new jobs arrived at 190,000 per month. Manufacturing continues to improve. Over the past year the sector has added 278,000 jobs — four-fifths of that growth taking place in the high-wage durable goods sector.

That could continue to improve as the nation’s manufacturing system continues to express optimism despite a worker shortage. According to the National Association of Manufacturers, “Nearly 93 percent of manufacturers are projecting further expansion for their businesses, and positive sentiment among smaller companies is up to 91.3 percent.”

In one of the only downsides of today’s report, Hurricane Florence may have caused some weakness in the Leisure and hospitality sector (-17,000).

Hispanic unemployment is at an all-time low.

Unemployment drifted downward for all groups by educational attainment (See chart below). "The labor market is in excellent shape heading into the end of 2018, perhaps the best it has been in 50 years," Gus Faucher, chief economist at PNC told CNBC. "Job growth was a bit softer in September, but some of that was from Hurricane Florence, and it should bounce back through the rest of 2018 and into 2019."

- The unemployment rate dropped to 3.7 percent in September with payrolls expanding by 134,000 jobs, according to the Bureau of Labor Statistics. The unemployment rate is the lowest since 1969.

- The Labor Force Participation (LFP) remained at 62.7 percent. The Employment-population ratio finished for the month at 60.4 percent, little changed. The number of unemployed for the month was 6.0 million, declining by 270,000.

- The economy added 137,000 jobs in September. Job gains took place in Professional and business services (+54,000), Health care (+26,000) and the Transportation and warehousing sector (+24,000).

- In addition, Construction added 23,000 jobs while Manufacturing added 18,000 jobs.

- According to the BLS, the following sectors saw little or no change in employment: Wholesale trade, Retail trade, Information, Financial activities and Government.

- Over the year, average hourly earnings have increased by 73 cents or 2.8 percent. In September the average hourly private nonfarm wage rang in at $27.24, an increase of eight cents. The average workweek for all employees was unchanged at 34.5 hours.

- Despite Hurricane Florence, the BLS said its surveys were within normal ranges. Major analysts appeared to agree.

- The number of persons employed part-time for economic reasons increased by 263,000 to 4.6 million. The number of long-term unemployed was little changed at 1.4 million. This group represents 22.9 of all unemployed persons.

ANALYSIS

Total nonfarm payroll employment rose by 134,000 in September well below the 12-month average of 201,000. Wall Street expected a payroll increase by 185,000 jobs. The BLS reported 121,000 new private sector jobs were created compared with the ADP payrolls report released earlier this week of 230,000 private payrolls.

While jobs created were below expectations, the BLS revised numbers for July (from 147,000 to 165,000) and August from 201,000 to 270.000). After revisions, the BLS found the three-month average for new jobs arrived at 190,000 per month. Manufacturing continues to improve. Over the past year the sector has added 278,000 jobs — four-fifths of that growth taking place in the high-wage durable goods sector.

That could continue to improve as the nation’s manufacturing system continues to express optimism despite a worker shortage. According to the National Association of Manufacturers, “Nearly 93 percent of manufacturers are projecting further expansion for their businesses, and positive sentiment among smaller companies is up to 91.3 percent.”

In one of the only downsides of today’s report, Hurricane Florence may have caused some weakness in the Leisure and hospitality sector (-17,000).

Hispanic unemployment is at an all-time low.

Unemployment drifted downward for all groups by educational attainment (See chart below). "The labor market is in excellent shape heading into the end of 2018, perhaps the best it has been in 50 years," Gus Faucher, chief economist at PNC told CNBC. "Job growth was a bit softer in September, but some of that was from Hurricane Florence, and it should bounce back through the rest of 2018 and into 2019."

|

| Chart by East Boston Economics - BLS,Table A4 - Educational Attainment |

Monday, September 24, 2018

Comments on the MA Employment Situation for August 2018: U-Rate: 3.6%; Jobs: +6,100 jobs; +68,100 YoY

OVERVIEW

- The state’s unemployment rate remained at 3.6 percent in August according to the federal Bureau of Labor Statistics.

- Over the last 12 months, Massachusetts added 68,100 jobs.

- The Labor Force Participation rate increased three-tenths of a percentage point to 67.6 percent.

- The state’s labor force population stands at 3.806 million. Since August 2017, the LFP rate is up 2.1 percentage points.

- The largest private sector job gains took place in the Education and Health Services (+2,500) the Leisure and Hospitality (+1,700), Professional, Scientific and Business Services (+1,500), Information (+900) and Construction (+500).

- Manufacturing and Trade, Transportation and Utilities each lost 600 jobs. Other Services lost 100 while Government added 100 jobs; over the past year this sector lost 500 jobs.

ANALYSIS

The August unemployment rate in Massachusetts again was three-tenths of a percentage point lower than the national rate of 3.9 percent.

"The August estimates indicate the Commonwealth’s labor force and employment are at their highest levels while our unemployment rate remains consistently low - all indicators of the continuing positive economic outlook for the Commonwealth of Massachusetts." Labor and Workforce Development Secretary Rosalin Acosta said last Friday.

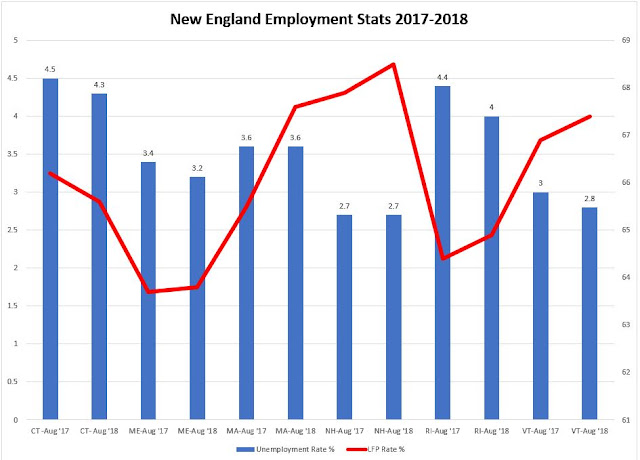

Massachusetts is the locomotive pulling New England states. New Hampshire was the only other New England with a statistically significant change from last August. Maine, along with New Hampshire and Vermont were the NE states with unemployment rates significantly different than the U.S. rate. Only one state, Connecticut saw a downturn in its LFP rate from 66.2 to 65.6 percent.

Year to date, all NE states are near the November 2017 estimates for 2018 by the New England Economic Partnership. (MA: 3.7; ME: 3.3; RI: 4.0; VT:3.0; NH 2.5 and CT: 48.)

Friday, July 20, 2018

Massachusetts Employment Situation: 3.5% URate with +21,400 new jobs

OVERVIEW

- The state’s unemployment rate remained at 3.5 percent in June according to the federal Bureau of Labor Statistics.

- Massachusetts added 63,200 jobs since June 2017 with the state’s unemployment rate decreasing three-tenths of a percentage point from 3.8 percent in June 2017.

- The state’s unemployment rate was five-tenths of a percentage point lower than the national rate of 4.0.

- The leisure and hospitality sector added 6,600 jobs.

- The largest private sector percentage gains over the year were in the construction, professional and other services.

- Professional, scientific and business services sector added 4,700 jobs while Other Services gained 2,500 jobs

- Construction added 2,300 jobs while manufacturing added 1,700 jobs.

- The information and financial activities sectors lost jobs over the month, 300 and 400 jobs respectively.

- Education and health services gained 1,000 jobs while trade, transportation and utilities remained unchanged.

- Government added 3,200 jobs but over the past year the level remained flat.

ANALYSIS

Sidelined workers in the Bay State are returning to the job market. At 66.9 percent, the state’s labor force participation rate is up 1.3 percent over June 2017. “Over the last year, over 100,000 more Massachusetts residents have become employed in the Commonwealth, helping to push our labor force participation rate to its highest level in 10 years - a full four percentage points higher than the national average.” Labor and Workforce Development Secretary Rosalin Acosta said today.

To match the lowest unemployment in recent decades (the 2.7 annual rate for the Year 2000), how many jobs would the state have to create at a LFP rate that increases by just another half of one percent?

According to the Federal Reserve Bank of Atlanta’s Jobs Calculator, the Bay State needs to create a monthly average of 7,463 jobs over the next 12 months at the same time increasing its LFP to 67.4 percent.

Whether an economy already at full employment can achieve such a goal is uncertain, yet there may be some room to grow if the economy exceeds expectations.

Meanwhile, manufacturing jobs still comprise a small share of Massachusetts total employment at 6.8 percent remaining above trend. However, the Wall Street Journal today reported that there are no longer any “manufacturing-intensive” counties in Massachusetts defined by a threshold whereby 25 percent of a state’s workforce is employed making things.

Friday, July 6, 2018

June 2018 Employment Situation: U-Rate: 4.0%; Jobs: +213,000

OVERVIEW

ANALYSIS

The U.S. economy added 213,000 jobs beating economists’ expectations in the range of 200,000 and 195,000 jobs.

The report looks even better when considering the revisions. April’s report was revised upward to 175,000 jobs from the previously reported 159,000 and May’s report was revised upward to 244,000 from 223,000. The BLS reported that after these revisions, job gains have averaged 211,000 per month over the last three months.

The private sector created 202,000 new jobs, a figure higher than this week’s ADP report for the same month (+177,000).

The unemployment rate rose to 4.0 percent from 3.8 percent but remains lower than 12 month ago (4.3 percent). The increase may be attributable to the 0.2 percentage point increase in labor force participation over the past month.

Over the past year the manufacturing sector has added 285,000 jobs, an impressive number that will be tested as trade disputes intensify with new tariffs on foreign goods.

Average hourly earnings for all employees rose by five cents to $26.98, representing a gain of 2.7 percent over the past year. The average work week remained at 34.5 hours.

The number of long-term unemployment increased by 289,000 to 1.5 million. These individuals who have been unemployed for more than 27 weeks account for 23 percent of all unemployed. The percent distribution of this group has increased over the past five months suggesting the hardships of returning to work after long periods of unemployment.

- The unemployment rate rose to 4.0 percent in June with payrolls expanding by 213,000 jobs, according to the Bureau of Labor Statistics.

- The Labor Force Participation (LFP) edged up by 0.2 percentage point to 62.9 percent. The employment-population ratio was unchanged in June at 60.4 percent and has remained flat since February. The number of unemployed for the month of June was 6.6 million. One year ago, that number was 7.0 million.

- In June employment grew in the manufacturing, health care, construction and mining sectors.

- Manufacturing added 36,000 jobs with durable goods manufacturing accounting for most of the increase.

- Professional and business services added 50,000 jobs. This sector has added 521,000 jobs over the past year. Retail lost 22,000 jobs in June offsetting May’s gain of 25,000 jobs.

- Employment in the other major sectors—wholesale trade, transportation and warehousing, information, financial activities, leisure and hospitality and government —changed little over the month.

- The average duration of unemployment declined over the past year from 24.9 to 21.2 weeks.

ANALYSIS

The U.S. economy added 213,000 jobs beating economists’ expectations in the range of 200,000 and 195,000 jobs.

The report looks even better when considering the revisions. April’s report was revised upward to 175,000 jobs from the previously reported 159,000 and May’s report was revised upward to 244,000 from 223,000. The BLS reported that after these revisions, job gains have averaged 211,000 per month over the last three months.

The private sector created 202,000 new jobs, a figure higher than this week’s ADP report for the same month (+177,000).

The unemployment rate rose to 4.0 percent from 3.8 percent but remains lower than 12 month ago (4.3 percent). The increase may be attributable to the 0.2 percentage point increase in labor force participation over the past month.

Over the past year the manufacturing sector has added 285,000 jobs, an impressive number that will be tested as trade disputes intensify with new tariffs on foreign goods.

Average hourly earnings for all employees rose by five cents to $26.98, representing a gain of 2.7 percent over the past year. The average work week remained at 34.5 hours.

The number of long-term unemployment increased by 289,000 to 1.5 million. These individuals who have been unemployed for more than 27 weeks account for 23 percent of all unemployed. The percent distribution of this group has increased over the past five months suggesting the hardships of returning to work after long periods of unemployment.

Monday, April 9, 2018

What happened to U.S. manufacturing employment?

New Perspectives on the Decline of US Manufacturing Employment by Teresa C. Fort, Justin R. Pierce and Peter K. Schott

Abstract:

Abstract:

We use relatively unexplored dimensions of US microdata to examine how US manufacturing employment has evolved across industries, firms, establishments, and regions. We show that these data provide support for both trade- and technology-based explanations of the overall decline of employment over this period, while also highlighting the difficulties of estimating an overall contribution for each mechanism. Toward that end, we discuss how further analysis of these trends might yield sharper insights.A gated copy of the paper is available here.

Friday, April 6, 2018

March 2018 U.S. Employment Situation -- U-rate, 4.1 percent; Payrolls +103.000

OVERVIEW

ANALYSIS

The March payroll jobs report could best be summed up as “less than stellar.” Economists were expecting a monthly gain of between 185,000 and 193,000 jobs. Most economists believe the U.S. economy has reached full employment with some worrying about running out of workers because of fast job growth. However, the number of involuntary part-time workers remained unchanged at 5 million while the number of marginally attached workers checked in at 1.5 million persons, a number not much different from last year. The number of part-time workers in the labor pool increased from 20.7 million in March 2017 to 21.3 million in March 2018. The retail sector returned to its current state of “disliked normalcy” with employment declining by 13,000 jobs in general merchandise stores, “offsetting a gain of the same size in February,” according to the BLS. Earnings in this sector have bounced back a bit since a decline that began in 2016 (See chart below). The LFP rate decreased from both February 2018 (month over month) and March 2017 (year over year). Today’s report included good news. Average hourly earnings have increased by 71 cents over the past year. Paul Ashworth, chief U.S. economist at Capital Economics, told Bloomberg News that despite the weak payrolls gain, "There is still evidence of an acceleration in the underlying pace of employment growth… looking through the volatility, employment growth is trending higher and wage growth is starting to heat up.” As a result, pressure will build on the U.S. Federal Reserve Bank to abide by its commitments to raise rates this year.

- The unemployment rate remained at 4.1 percent for the sixth consecutive month in March with payrolls expanding by 103,000 jobs, according to the Bureau of Labor Statistics.

- The Labor Force Participation (LFP) changed little at 62.9 percent. The employment-population ratio was unchanged at 60.4 percent.

- In March the employment grew in the manufacturing, health care and mining sectors with the durable goods sub-sector accounting for approximately three-fourths of the gain in manufacturing.

- Health care added 22,000 jobs a gain consistent with the past 12-month average while construction slowed down after a February gain.

- Professional and business services added 33,000 jobs. This sector has added 502,000 jobs over the past year.

- After increasing 47,000 in February, retail lost 4,000 jobs in March.

- Employment in the other major sectors—wholesale trade, transportation and warehousing, information, financial activities, leisure and hospitality and government —changed little over the month.

- Average hourly earnings for all employees rose by 8 cents to $26.82, representing a gain of 2.7 percent over the past year. The average work week remained at 34.5 hours.

ANALYSIS

The March payroll jobs report could best be summed up as “less than stellar.” Economists were expecting a monthly gain of between 185,000 and 193,000 jobs. Most economists believe the U.S. economy has reached full employment with some worrying about running out of workers because of fast job growth. However, the number of involuntary part-time workers remained unchanged at 5 million while the number of marginally attached workers checked in at 1.5 million persons, a number not much different from last year. The number of part-time workers in the labor pool increased from 20.7 million in March 2017 to 21.3 million in March 2018. The retail sector returned to its current state of “disliked normalcy” with employment declining by 13,000 jobs in general merchandise stores, “offsetting a gain of the same size in February,” according to the BLS. Earnings in this sector have bounced back a bit since a decline that began in 2016 (See chart below). The LFP rate decreased from both February 2018 (month over month) and March 2017 (year over year). Today’s report included good news. Average hourly earnings have increased by 71 cents over the past year. Paul Ashworth, chief U.S. economist at Capital Economics, told Bloomberg News that despite the weak payrolls gain, "There is still evidence of an acceleration in the underlying pace of employment growth… looking through the volatility, employment growth is trending higher and wage growth is starting to heat up.” As a result, pressure will build on the U.S. Federal Reserve Bank to abide by its commitments to raise rates this year.

Friday, February 2, 2018

Notes on today's U.S. payrolls number and unemployment rate: +200,000 jobs; 4.1 percent

OVERVIEW

- The unemployment rate remained at 4.1 percent for the fourth consecutive month in December while payrolls expanded by 200,000, according to the Bureau of Labor Statistics.

- The Labor Force Participation (LFP) remained at also remained at 62.7 percent for the fourth straight month. The employment-population ratio was unchanged at 60.1 percent for the third straight month.

- Construction added 36,000 jobs in January.

- Employment in food services and drinking places added 31,000 jobs while employment in health care added 21,000 with 13,000 of those jobs in hospitals.

- The manufacturing sector added 15,000 jobs continuing a trend. In the past 12 months, the sector has added 186,000 jobs.

- Employment in the other major sectors— mining, wholesale trade, retail trade, transportation and warehousing, information, financial activities, professional services and government —changed little over the month.

- The November 2017 number was revised downward from 252, 000 to 216,000 and the December 2017 payrolls number was revised up from 148,000 to 160,000.

ANALYSIS

After a disappointing December print, the labor market picked up in January. After revisions to earlier reports, job gains averaged 192,000 months for the past three months. A survey of Wall Street Journal economists expected an increase of 177,000 jobs. According to an ADP report earlier this week, private sector employment increased by 234,000 jobs in January. Also, this past week saw a Labor Department report showing that initial claims for state unemployment benefits slipped 1,000 to a seasonally adjusted 230,000 for the last week of the month. According to Reuters this represents the 152nd week of claims settling below the 300,000 threshold associated with a strong economy. Wage growth underscores the tight labor markets. This wage growth is the fastest since the Great Recession. However, the labor force participation rate remains low by historical standards; the rate only declined by one-tenth of a percentage point since last January. In addition, the broader measure which includes discouraged workers, the U-6 rate increased to 8.2 percent. The decline in African-American workers proved to be a bump. After falling to 6.8 percent in December, the rate for black workers rose to 7.7 percent last month. Despite the recent wage increases overall, the lower-wage food services and drinking places sector grew faster than higher wages sectors such as professional and technical services over the past 10 years. (See chart below.)

Friday, January 5, 2018

Manufacturing says "See you in December": BLS: NFP +148,000 U-Rate 4.1%

OVERVIEW

- The unemployment rate remained at 4.1 percent for the third consecutive month in December while payrolls expanded by 148,000, according to the Bureau of Labor Statistics.

- The Labor Force Participation (LFP) remained at 62.7 percent. The employment-population ratio was unchanged at 60.1 percent.

- Employment in health care increased by 31,000 while construction added 36,000 jobs.

- The manufacturing sector added 25,000 jobs. The BLS reports that this sector added 196,000 jobs in 2017 after a dismal 2016 which saw a loss of 16,000 jobs.

- Professional and business services kept pace in 2017 with the previous year adding 44,000 jobs per month. In December, the sector added 19,000 jobs

- Employment in the other major sectors— mining, wholesale trade, transportation and warehousing, information, financial activities and government —changed little over the month.

- Over the year, the BLS reports the unemployment rate and the number of unemployed were down by 0.6 percentage point and 926,000, respectively.

ANALYSIS

In December, the American jobs machine took a breather. The payroll employment (+148,000) fell below the Wall Street consensus of 190,000 jobs. According to an ADP report earlier this week, private sector employment increased by 250,000 jobs in December. The unemployment rate for the major work groups remained low. The unemployment rate for African-Americans fell to 6.8 percent the lowest ever. The retail sector fared better under the last year of the previous administration where it increased by 203,000 in 2016. In 2017 it lost 67,000. Employment in general merchandise edged down in 2017 shedding 67,000 jobs. However, Manufacturing added 196,000 jobs in 2017 following little net change in 2016. The November employment report was revised up from +228,000 to +252,000 and the change in October was revised down from +244,000 to +211,000 (Combined over two months, a net loss of 9,000 jobs). Over the past three months, job gains have averaged 204,000 a month. In December, average hourly earnings for all employees increased by 9 cents to $26.63; over the past year, hourly earnings have risen by 65 cents or 2.5 percent. The labor force participation rate has not changed over the year. It remains at 62.7 percent. The number of workers employed part-time for economic reasons has declined by 639,000 over the past year.

Friday, December 8, 2017

US EMPSIT November 2017: 4.1 percent U-Rate; Payrolls +228,000

OVERVIEW

- The unemployment rate remained at 4.1 percent in November while payrolls expanded by 228,000, according to the Bureau of Labor Statistics.

- The Labor Force Participation (LFP) remained at 62.7 percent for November. The employment-population ratio was little changed at 60.1 percent.

- The manufacturing sector added 31,000 jobs. The BLS reports “that since a recent low in November 2016, manufacturing has increased by 189,000 jobs.”

- Professional and business services added 46,000 jobs in November and health care added 30,000.

- Employment in the other major sectors— mining, wholesale trade, retail trade, transportation and warehousing, information, leisure and hospitality, financial activities and government —changed little.

- In November, average hourly earnings for all employees increased by 5 cents to $26.55; over the past year, hourly earnings have risen by 64 cents or 2.5 percent.

- The September employment report was revised up from +18,000 to +38,000 and the change in October was revised down from +261,000 to +244,00 Over the past three months, job gains have averaged 170,000 a month. The six-month average monthly growth is 177,600. From January, the economy added on average 174,000 monthly jobs.

ANALYSIS

In November, the American factory kicked into high gear. Since last year the manufacturing sector has added 189,000 jobs. Subsector growth took place in machinery (+8,000), fabricated metal products (+7,000), computer and electronic products (+4,000), and plastics and rubber products (+4,000). The payroll employment report exceeded the Wall Street consensus of 200,000 jobs. According to an ADP report earlier this week, private sector employment increased by 190,000 jobs in November. The unemployment rolls decreased over the past 12 months by 799,000 workers. The number of part-time for economic reasons remained at 4.8 million. Nonetheless, there is talk of a labor shortage in the manufacturing sector where employers are investing in resources to train new workers and by increasing automation. The tight labor market suggests that wages should be increasing faster that today’s reported annual rate of 2.5%. But percentage growth in lower paid jobs since 2007 in the leisure and hospitality sectors (0.2) have outstripped high-value-adding professional and business services (0.1) and the overall job (0.1) growth (See table below). Another view is more generational than structural. According to USAToday, “Some economists say the government's measure of average earnings growth may be skewed downward by the retirements of higher-paid Baby Boomers and the entry into the labor force of lower paid Millennials.” For now, holding a job is more important than higher wages. Overall, the job market is on solid ground giving the Federal Reserve an opportunity to raise rates.

PDF version of this post.

Thursday, August 17, 2017

Today's Massachusetts jobs number: 4.3% U-rate; 200 jobs lost in July 2017

OVERVIEW

- The state’s total unemployment rate increased to 4.3 percent in July and lost 200 jobs according to the Executive Office of Labor and Workforce Development.

- Since last July the state’s economy has added 45,200 jobs while the state’s labor force participation rate has increased by 1.5 percent.

- The strongest job growth came in the Construction (+2,500), with Financial Activities and Education & Health Services each adding 1,300 jobs.

- Trade, Transportation & Utilities lost 1,400 jobs over the month while Leisure and Hospitality lost 900 jobs. Information lost 300 jobs; Professional, Scientific and Business Services lost 100.

- Government lost 1,700 jobs over the month and Other Services lost 1,400 jobs.

- The new jobs estimate for June was revised to 10,900 from the 10,000 jobs reported originally.

- Over the past year, the Health Care and Social Assistance subsector added 20,600 jobs, a sector whose year-over-year growth is nearly four times that of the growth of the Financial Activities sector.

- On average, Massachusetts employment grew by 3,767 jobs a month since last July.

- On average, the private sector generated 3,575 jobs monthly over the past 13 months.

ANALYSIS

The state’s unemployment rate, which inched up in July, has converged with the national rate at 4.3 percent.

According to the EOLWD, the last time the state and national rates matched was April 2008 when the rate was 5.0 percent. Over the year, the state’s seasonally adjusted unemployment rate increased seven-tenths of a percentage point from 3.6 percent in July 2016.

Meanwhile, the LFP rate increased by three-tenths of a point to 66.4 percent in July.

The labor force decreased by 11,300 from 3,708,800 in June, says EOLWD as 11,500 fewer residents were employed and 300 more residents were unemployed.

The unemployment rate remains at a stable low level but the state faces a skills gap. This may be reflected in the subpar growth of mid-tech jobs classified under Leisure and Hospitality and Other Services.

“Although the unemployment rate remains low, we continue to see persistent gaps between the skill sets of available workers and the qualifications needed for in-demand jobs,” Labor and Workforce Development Secretary Rosalin Acosta said.

Job growth in Massachusetts continues to rely on the strength of the Education and Health Care and Professional Services super-sectors, which saw gains of 21,900 and 9,500 over the past year, respectively. In related news, the most recent Boston metropolitan survey released this week by the Bureau of Labor Statistics showed job growth over the past year across all sectors except for manufacturing.

Friday, July 21, 2017

MA Employment Situation: Urate: 4.3 percent -- 10,000 jobs added in June

OVERVIEW

ANALYSIS

"During the first six months of 2017, Massachusetts has experienced the largest increase in the labor force on record, and the 66.7 labor force participation rate is now 3.9 points higher than the U.S. rate. These marked labor force gains should help ease labor market pressures and are signs of a growing economy in the Commonwealth," Labor and Workforce Development Secretary Rosalin Acosta said upon yesterday’s release.

The increase in the unemployment rate is due to the fact more workers are rejoining the labor force. The LWD office says that 121,400 workers re-entered the market from June 2016. Only construction and professional services lost jobs over the month. But all other sectors posted strong growth with education and health services leading the way.

Government continues to grow employment rising by 1.2 percent over the past year.

The growth in Massachusetts jobs should ensure that state income tax revenues grow, thus alleviating some of the sales tax revenue drift.

The often-neglected “Other Services” category continues to move with Professional, Scientific and Business Services as a percentage of total nonfarm employment, roughly 4 percent and 15 percent respectively.

- The state’s total unemployment rate increased to 4.3 percent in June from the May rate of 4.2 percent according to the Executive Office of Labor and Workforce Development.

- Preliminary estimates suggest that Massachusetts added 10,000 jobs in June. Since last June the economy has added 65,900 jobs.

- The labor force participation rate (LFP) remained at 66.7 percent over the month; however, this represents a 1.8 percent increase from June 2016.

- Education and Health Services added 6,700 jobs over the month. Over the year, Education and Health Services gained 28,200 jobs.

- Information added 200 jobs over the month; over the year, this sector gained 1,300 jobs.

- Federal, state and local government combined gained 400 jobs (5,500 over the past 12 months).

- Professional, Scientific, Business Service subsector lost 2,200 jobs bringing year over year to 13,900.

- Construction lost 2,800 jobs in June but since last year the sector has added 1,800 jobs.

- In June, the manufacturing sector gained 500 jobs but posted a 12-month loss of 1,400 jobs.

- The May estimate was revised with a gain of 2,000 jobs as opposed to the 2,900 originally reported.

ANALYSIS

"During the first six months of 2017, Massachusetts has experienced the largest increase in the labor force on record, and the 66.7 labor force participation rate is now 3.9 points higher than the U.S. rate. These marked labor force gains should help ease labor market pressures and are signs of a growing economy in the Commonwealth," Labor and Workforce Development Secretary Rosalin Acosta said upon yesterday’s release.

The increase in the unemployment rate is due to the fact more workers are rejoining the labor force. The LWD office says that 121,400 workers re-entered the market from June 2016. Only construction and professional services lost jobs over the month. But all other sectors posted strong growth with education and health services leading the way.

Government continues to grow employment rising by 1.2 percent over the past year.

The growth in Massachusetts jobs should ensure that state income tax revenues grow, thus alleviating some of the sales tax revenue drift.

The often-neglected “Other Services” category continues to move with Professional, Scientific and Business Services as a percentage of total nonfarm employment, roughly 4 percent and 15 percent respectively.

Both are strongly correlated. The Bureau of Labor Statistics defines “Other Services” as those jobs (except for Public Administration) that provide services such as machine repair, administering religious services, grantmaking, personal and pet care services as well as other establishments. Sector growth since the last recession has been mostly flat at 0.22 percent since 2007.

Friday, July 7, 2017

Analysis of US EMPSIT U-Rate 4.4%; Jobs added: 220,000;

OVERVIEW

ANALYSIS

The payroll employment report highlighting 220,000 new jobs exceeded the Wall Street consensus of 170,000 jobs. The new number arrived as a pleasant surprise. According to an ADP report earlier this week, private sector employment increased by 158,000 jobs from May to June. According to the BLS, employment growth has averaged 180,000 per month thus far this year — slightly below the 2016 average monthly gain of 187,000.

The positive news in today’s report underscores that since January, the unemployment rate and the number of unemployed are down by 0.4 percentage point and 658,000. The rolling three-month average with the new revisions indicate job gains of 194,000 a month.

However, the LFP rate continues to plague the jobs recovery; it has changed little from 62.8 percent and shows “no clear trend over the past year.” The number of persons employed part-time (but who would like more hours), was little changed at 5.3 million. In June, 1.6 million persons were marginally attached to the labor force, down by 197,000.

The BLS estimates that 1.1 million persons marginally attached remain out of the workforce for reasons such as family responsibilities and school attendance. Teen-age unemployment has trimmed down from 15.9 percent last June to 13.3 percent in June 2017.

Relative to the growth in jobs, wage gains remain weak. The report "is another illustration that the real economy is in good health," said Paul Ashworth, chief U.S. economist at Capital Economics. "The only disappointment is that wage growth still shows few signs of accelerating."

PDF version of this Research Note

- The unemployment rate rose to 4.4 percent in June while payrolls expanded by 222,000, according to the Bureau of Labor Statistics.

- The Labor Force Participation (LFP) rate rose by 0.1 percentage point to 62.8 percent for June. The employment-population ratio was little changed at 60.1 percent.

- Health care added 37,000 jobs and social assistance added 23,000 jobs.

- Employment in the other major sectors— construction, manufacturing, wholesale trade, retail trade, transportation and warehousing, information and government —were unchanged.

- Employment in the financial activities sector rose by 17,000 in June after stalling in May.

- In June, average hourly earnings for all employees increased by 4 cents to $26.25, representing a 2.5 percent year over year increase.

- In June, employment in the professional services sector rose by 35,000.

- The April employment situation report was revised up from 174,000 to 207,000 and the change from May was also revised up from the 138,000 to 152,000. The two-month revisions accounted for 47,000 jobs that were previously not identified.

- The average workweek for all employees rose by 0.1 hour to 34.5 hours.

ANALYSIS

The payroll employment report highlighting 220,000 new jobs exceeded the Wall Street consensus of 170,000 jobs. The new number arrived as a pleasant surprise. According to an ADP report earlier this week, private sector employment increased by 158,000 jobs from May to June. According to the BLS, employment growth has averaged 180,000 per month thus far this year — slightly below the 2016 average monthly gain of 187,000.

The positive news in today’s report underscores that since January, the unemployment rate and the number of unemployed are down by 0.4 percentage point and 658,000. The rolling three-month average with the new revisions indicate job gains of 194,000 a month.

However, the LFP rate continues to plague the jobs recovery; it has changed little from 62.8 percent and shows “no clear trend over the past year.” The number of persons employed part-time (but who would like more hours), was little changed at 5.3 million. In June, 1.6 million persons were marginally attached to the labor force, down by 197,000.

The BLS estimates that 1.1 million persons marginally attached remain out of the workforce for reasons such as family responsibilities and school attendance. Teen-age unemployment has trimmed down from 15.9 percent last June to 13.3 percent in June 2017.

Relative to the growth in jobs, wage gains remain weak. The report "is another illustration that the real economy is in good health," said Paul Ashworth, chief U.S. economist at Capital Economics. "The only disappointment is that wage growth still shows few signs of accelerating."

PDF version of this Research Note

Subscribe to:

Posts (Atom)

Indicators

Test